[Easy Taxation] Rebate of Period-end VAT Retained for Some Advanced Manufacturing Industries Is Available Online!

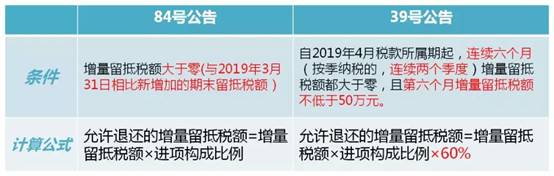

The policies concerning rebate of VAT retained for some advanced manufacturing industries are published in CS Document No. 84-2019! Let's compare the difference in such policies between some advanced manufacturing industries and other industries.

Precautions: Some advanced manufacturing industries mentioned herein refer to the taxpayers who produce and sell non-metallic mineral products, general equipment, special equipment and computers, communications and other electronic equipment in accordance with the Industrial Classification for National Economic Activities, with sales of more than 50% of the total sales volume.

Now eligible taxpayers may operate directly in the electronic tax service, let's learn about how to operate!

Premises:

1. Normal registration status of taxpayers

2. Identification of category of value-added tax for taxpayers

3. Tax-paying credit rating of taxpayers is A or B

4. Taxpayers own CA digital certificate

Tips: Operate within the declaration period!

Steps: log in the website of electronic tax service, click "management of general tax rebate (deduction) " in the menu bar "tax service", and select “rebate of period-end VAT retained (2019)" on the right side of the pop-up page, and click to enter the processing page.

You can also search for the “rebate of VAT retained" through the search bar above the page to enter the processing page.

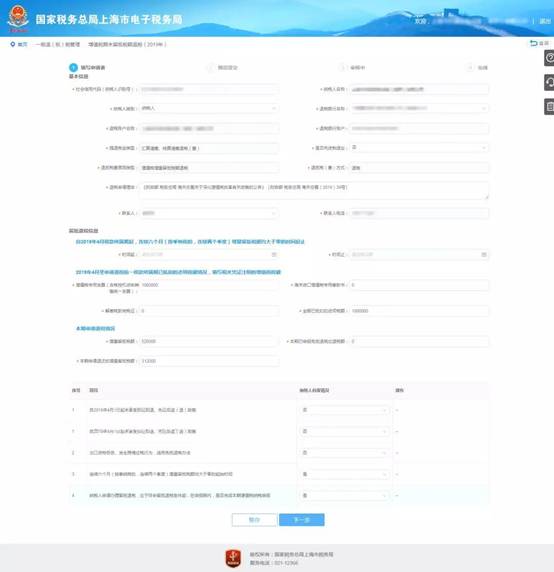

Step 1: Complete the form

1. The taxpayer information system pops up automatically.

2. For "advanced manufacturing industry or not", select "no" to pop up the contents of non-advanced manufacturing industry. The form is as follows:

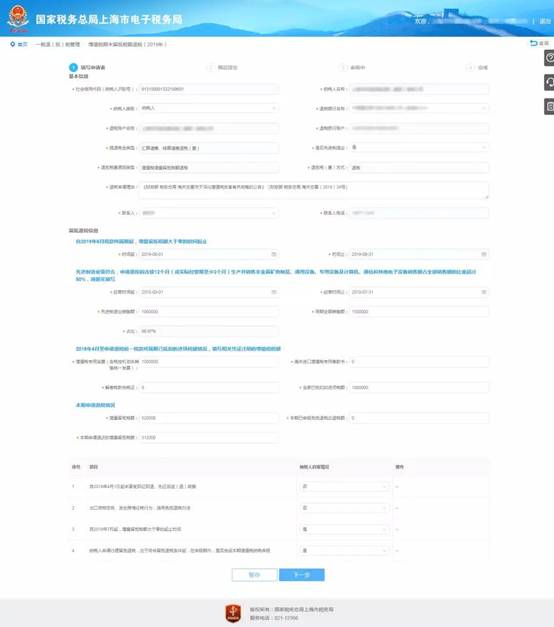

If "yes" is selected, the operation page of advanced manufacturing industry will display as below:

3. After filling out the application information according to the actual situation, click [next] to enter the preview page.

Step 2: Preview and submit

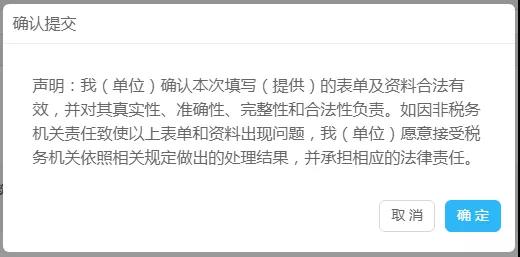

No data need to be attached to this item, click [next] to enter the preview form, and click [submit] in case of no more problems. If not, click [back] to modify.

The confirmation page will pop up, and click [ok].

Step 3: Handle successfully

The items submitted successfully may be checked for acceptance status in "inquiry" - "taxation progress and result information inquiry".

1. Click "view" to inquire the details.

2. The matters are handled.

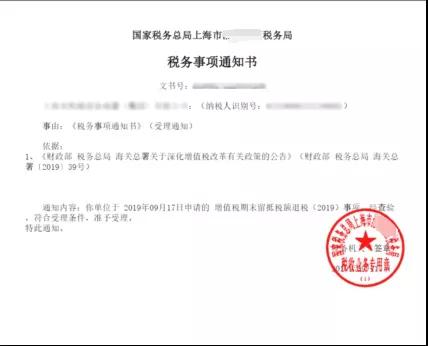

3. After acceptance by the tax authority, taxpayers may download the Notice of Tax Matters in the following format:

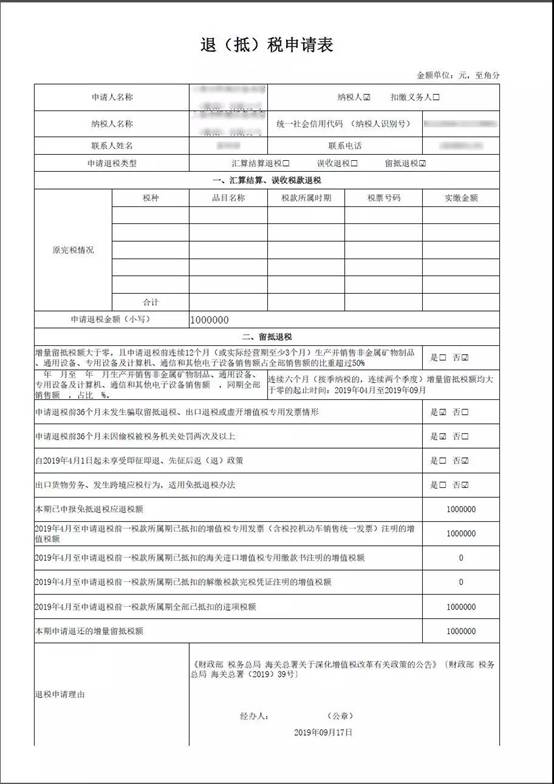

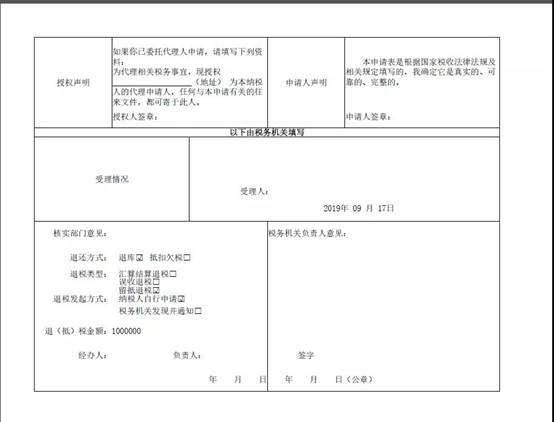

The format of the Application Form for Tax Rebate (Deduction) is as follows:

After all, you definitely better acquaint with the operation of the rebate of period-end VAT retained of advanced manufacturing industry!

搜索

搜索

搜索

搜索 导航

导航