Recently, Electronic Tax Service has been upgraded, and one of its new functions is to provide taxpayers with simple features of business elements with one-time confirmation declaration for 7 tax types, including VAT and surcharges, consumption tax and surcharges, enterprise income tax, and construction fees for cultural undertakings. The system automatically extracts data, automatically calculates tax amount, automatically generates elementized forms, and completes the declaration after the taxpayers' confirmation, realizing the Simplified Confirmation Declaration function of "one confirmation, one submission" for multiple taxes and fees.

Now, relevant operation procedures will be introduced to you.

I. Functional Paths

Path 1: Electronic Tax Service-I Want to Handle Tax Affairs-Featured Businesses-Simplified Confirmation Declaration.

Path 2: Electronic Tax Service-Enter "Simplified Confirmation Declaration" by entering a keyword in the search box on the home page.

II. Operational Steps

1. Click the "Simplified Confirmation Declaration" function, and then the system automatically determines whether the taxpayer meets the rules of Simplified Confirmation Declaration, and if so, the system automatically enters the navigation page of tax and fee type selection.

2.After entering the navigation page of tax and fee type selection, the system automatically lists all the tax and fee types to be declared by the taxpayer. For tax and fee types that meet the conditions of Simplified Confirmation Declaration, the system will check all the boxes by default, and the taxpayer can choose and adjust them according to the actual situation; for tax and fee types that do not meet the conditions, the system will not check the boxes by default, and will provide guidelines for declaration of single tax and fee types, and the taxpayer can make declarations according to the guidelines.

After selection, the taxpayer should click “Go Handle” button to enter the interface of trial calculation of taxes and fees.

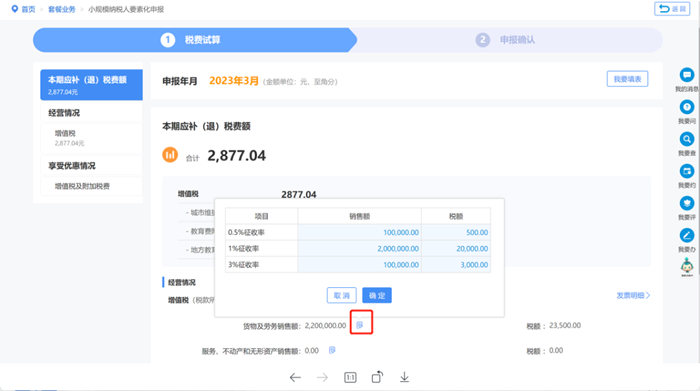

3. Entering the interface of trial calculation of taxes and fees, the system automatically displays the total amount of tax reimbursement or refund due for the period of the taxpayer's selected tax types, sales of goods and services, sales of services, real estate and intangible assets, operating income, operating costs, total profit and other elements according to the taxpayer's characteristic information.

1)Confirmation of tax (fee) results by the taxpayer:

2) If the taxpayer needs to adjust the data of relevant elements according to the actual operation situation, he/she can edit and adjust the data. If there is a situation of uninvoiced income, the taxpayer can make supplementary entries of uninvoiced income for goods and services respectively. Click the "OK" button after the input is completed.

3) If the taxpayer needs to enter the tax return filling interface, click "I Want to Fill in the Form" to enter the form-filling declaration mode.

4) The taxpayer can click "Next" after confirming that the relevant data are correct.

4. Enter the declaration confirmation page, which shows the detailed information of the taxpayer's selected tax and fee type such as sales amount, tax payable, and amount of tax reimbursement or refund due for the period. If the taxpayer needs to check the information, he/ she can click the "View Tax Return" button to view the standardized return of the corresponding tax and fee type. After confirming that the information is correct, the taxpayer should click "Submit" to file the return.

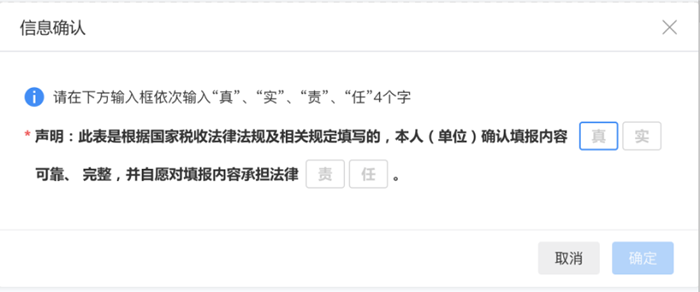

5. After the tax return is submitted, the taxpayer needs to enter "true" and "responsibility" to complete the submission and confirmation, and click "OK" button to submit the declaration data after the input is completed.

6. After successful declaration, the taxpayer can check the details of this successful declaration and pending payments. The taxpayer can pay taxes and fees in two ways: "Pay Now" and "Make Appointment for Payment".

III. Frequently Asked Questions

1.How should taxpayers declare the data items not covered in those available to be supplemented on the interface of the Simplified Confirmation Declaration for the current period?

Answer: The taxpayers can click the [I Want to Fill in the Form] function on the interface of Simplified Confirmation Declaration to enter into the form-filling mode for declaration.

2.How should taxpayers operate if they need to enjoy the preferential policies for key groups of people or self-employed retired soldiers?

Answer: Taxpayers can click [Tax Credit Report] on the Tax and Fee Trial Calculation page to collect preferential policy information.

3.Where should taxpayers report VAT with uninvoiced income?

Answer: Click "Sales of Goods and Services" or "Sales of Services, Real Estate and Intangible Assets" under Business Situation - VAT, and then fill out related information in the pop-up window displayed. The pop-up box will bring out the invoice data by default, and if there is any uninvoiced income, just add the uninvoiced income on top of the brought out data.

4.How should taxpayers correct a data entry error after they have successfully filed a simplified declaration?

Answer: Taxpayers can make corrections to incorrectly filed returns through the "I Want to Handle Tax Affairs-Tax and Fee Declaration and Payments-Declaration Correction and Cancellation" function, or search for Declaration Correction and Cancellation through the Search Function in the upper right corner to make corrections to incorrectly filed returns.

5.If taxpayers still want to use the traditional form filing mode for declaration, how should they make the declaration under the traditional form filing mode?

Answer: In the first line of the declaration mode page, "I Want to Fill in the Form" is displayed evidently, and taxpayers can click on "I Want to Fill in the Form" to enter the declaration mode of traditional form filling.

搜索

搜索

搜索

搜索 导航

导航