Recently, the online service platform "Shanghai Online Business Registration" has been newly launched, which provides domestic and foreign investors with all-session, all-type and all-weather business registration services in a "one-stop shop" manner.

So for taxpayers, how should they handle tax-related matters such as enterprise establishment and cancellation?

01 [Automation of New Business Opening]

After a taxpayer logs on to the platform of the “Government Online Offline Shanghai” --"Shanghai Online Business Registration"and completes the registration with the municipal supervision department, the tax authority accurately identifies the risk of the taxpayer's business opening by intelligently sensing the business opening data of the municipal supervision department, realizes risk-free automatic registration, and automatically assigns the competent tax authorities by opening an Electronic Tax Service account; and through the preset rules for identification of tax and fee types, it automatically completes the identification of tax and fee types, and synchronously completes the approval of several types of electronic invoices, so as to realize that the taxpayer can issue invoices as soon as it opens for business.

Specific Processes:

1. The taxpayer completes the business opening registration with the municipal supervision department.

2. The tax authority intelligently senses the business opening information of the municipal supervision department, automatically completes the registration of the taxpayer with the tax authority, and opens an Electronic Tax Service account.

3. Relying on the "Shuijishi" system, the tax authority automatically completes the allocation of competent tax authorities.

4. According to the preset rules of the system, the tax authority automatically completes the identification of tax and fee types.

5. The tax authority automatically completes the approval of invoice types and notifies the taxpayer by SMS.

6. When the taxpayer receives the SMS notice, he/she logs into the Electronic Tax Service and proceeds with the invoicing.

After receiving the SMS notice of successful business opening, the taxpayer logs in at the website of Shanghai Electronic Tax Service.

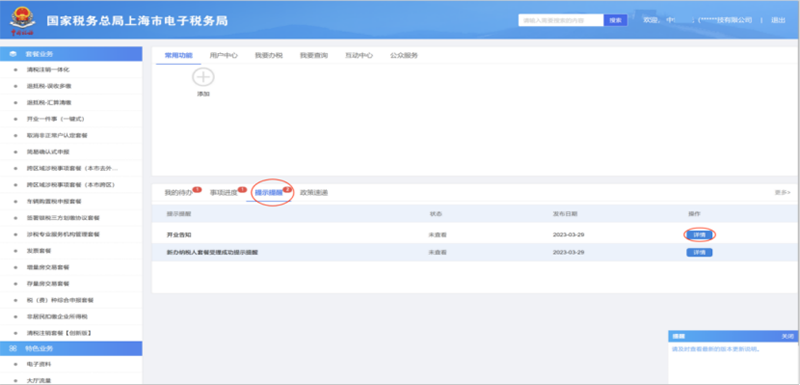

After entering the home page of the Electronic Tax Service, you can see two messages under the Alert Reminder column. Click on the <Details> button after the business opening notice.

When the <Notice of Electronic Tax Service on "New Intelligent Business Opening"> pops up on the screen, you can click the <Business Opening Notice> button to view the business opening information.

The page jumps to the information page, and you can view the business opening information, including seven categories of information content: basic information, contact information, registered investment information, institutional information, withholding information, and tax (fee) type identification and invoice type approval information.

There is no change in the operation of the new intelligent business opening compared to the previous business opening of taxpayers, and the relevant business is still handled in “one-stop shop” manner through the Shanghai “One-Window Handling” Online Service Platform for Starting a Business or the “One-Window Handling” Service in the application“Suishenban”.

02[No Worry about Business Cancellation]

A taxpayer can use the electronic business license of the market entity to be canceled to log on to the platform of "Government Online Offline Shanghai" - "Shanghai Online Business Registration" to apply for registration for the market entity’s cancellation. The "Shanghai Online Business Registration" platform connects the business processes of market regulation, taxation, human resources and social security, customs and other departments in handling business cancellation, and realizes e-government services with the functions of information interoperability and sharing, and full-process progress tracking, etc..

Simplified Cancellation

According to the Announcement on Simplifying the Handling of Tax-Related Matters in the Business Closure and Cancellation Segments of Market Entities (Announcement No. 12 [2022] of theState Taxation Administration), starting from July 14, 2022, individual businesses established and registered afterthe implementation of the "two-certificate integration" reform who have not dealt with any tax-related matters, or who have dealt with any tax-related matters, but have not received any invoices, or issued invoices on behalf of the other market entities, and who owe no tax or have no other outstanding matters, are exempted from the need to go to the tax authorities for the proof of tax clearance, and they may apply for the registration for cancellation to the market supervision department directly.

In order to continuously optimize the simplified cancellation procedure and further enhance the efficiency of simplified cancellation in the city, enterprises can launch the online application for objection pre-check and obtain the tax pre-check result online during the public notice period of the simplified cancellation through the "Pre-check for Objections to Simplified Cancellation" function of "Shanghai Online Business Registration".

After a market entity makes a simplified cancellation announcement, the information of the simplified cancellation announcement will be synchronized with the tax authority, and the pending tasks of the outstanding matters of the simplified cancellation will be generated in the corresponding taxpayer's "My To-Do" in the Electronic Tax Service. The taxpayer can log in to the Electronic Tax Service directly, and through [My To-Do] on the tax handling desktop, click the [Details] button to enter the function of "Inquiry on Tax-related Matters Not Yet Completed by Simplified Cancellation Taxpayers" to enquire about the outstanding matters of taxation and handle such matters correspondingly according to the prompts.

After the expiration of the simplified cancellation announcement, the system will no longer provide the inquiry function. After the expiration of the announcement period, if the taxpayer is not canceled successfully, that is, the taxpayer can still log in to the Electronic Tax Service, and when he/ she enters the function, the system will pop up a prompt as follows. Click [I Know] and the page will be closed.

General Cancellation

According to the provisions of Document No. 149 [2018] of the State Taxation Administration and Document No. 64 [2019] of the State Taxation Administration, for taxpayers who meet the qualifications for immediate cancellation, their cancelation can be implemented with the commitment system if they pass the verification of the conditions for immediate cancellation. For taxpayers who do not satisfy the qualification for immediate cancellation, they can also file an application at Electronic Tax Service and complete the cancellation after approval in accordance with the general cancellation process.

Taxpayers log into the Government Online Offline Shanghai, enter the tax cancellation page, fill in the application information, select "Reason for Cancellation" and "Operator" in the drop-down box, and click "Next", and then the system will verify all the indicators of the taxpayers.

Taxpayers who meet the conditions for immediate cancellation can continue to apply for cancellation, or they can choose to bring a letter of commitment and relevant information to the competent tax authorities to apply for cancellation at the tax service hall.

After the verification is completed, you can view in detail the indicators that failed to pass the verification in the three major categories of monitoring indicators by switching the tabs.

The first column is "qualification for immediate cancellation". There are six types of situation for immediate cancellation, and meeting any one of them means satisfying the conditions for immediate cancellation, and the second and third columns are the outstanding matters of the taxpayers.

After all matters are completed, click "Re-verify" and you will be prompted to click "Apply for Cancellation" and download the tax clearance certificate (cancellation notice).

Enterprises that meet the conditions for immediate cancellation click "Apply for Cancellation". A prompt pops up to "Confirm whether to carry out the cancellation", after it’s confirmed that there is no error, click "OK", and then jump to the interface for downloading the tax clearance certificate (cancellation notice).

Enterprises that do not meet the conditions for immediate cancellation apply for cancellation through the general process, which is to click on "Apply for Cancellation" to initiate the general cancellation process, fill out the application form, confirm that there is no error and then submit the task, download and print the acceptance notice after the application is accepted by the tax staff, and complete the cancellation after the application is approved.

Enterprises that have completed the cancellation can print the tax clearance certificate (cancellation notice) through the Electronic Tax Service - Login - No Login Function – Cancellation Registration Inquiry Module.

Enterprises whose general cancellation announcement period has expired and whose application for cancellation has been approved by the tax authorities can continue with the subsequent process.

搜索

搜索

搜索

搜索 导航

导航