[Must-read Guidance for Tax Period] How practical is the function of precise push for the rebate of incremental VAT retained? Let’s learn about it through this article.

I. Overview

Since the tax period of December 2020, to general taxpayers who possibly meet the conditions for rebate of incremental VAT retained stated in the Announcement of the Ministry of Finance, State Taxation Administration and General Administration of Customs on Policies Related to the Deepening of VAT Reform (Announcement No. 39 [2019] of the Ministry of Finance, State Taxation Administration and General Administration of Customs) and the Announcement of the Ministry of Finance and the State Taxation Administration on Clarifying the Policies on the Refund of Term-End Excess Input Value-Added Tax Credits in Certain Advanced Manufacturing Industries (Announcement No. 84 [2019] of the Ministry of Finance and the State Taxation Administration), the prompt of policies available to enjoy will be pushed automatically when they file the VAT return through the electronic tax service, reminding taxpayers to apply for handling the rebate of incremental VAT retained immediately.

II. Operation

In the tax period of the present month, taxpayers should first complete the filing of VAT return for general taxpayers. The specific path is as shown below:

Electronic Tax Service –I Want to Handle Tax Affairs-VAT Filing and Payment –Filing of VAT and Additional Taxes –Cloud Filing by General VAT Taxpayers

1. Log on to the Electronic Tax Service, click the “VAT Filing and Payment” module in the menu of “I Want to Handle Tax Affairs”.

2. Select “Filing of VAT and Additional Taxes” on the left side of the pop-up page, select “Cloud Filing by General VAT Taxpayers”, and click it to enter the filing page.

3. Click the“Enter Form-filling Mode”button on the filing page.

4. Enter the filing interface and fill in the Attached Material I, Attached Material II, Attached Material III, Main VAT Return, and Additional Taxes Return successively. “Required” returns should be clicked to fill in and saved; “Selective” returns should be selected to fill in upon demand, and those not required to fill in need not be clicked to open.

5. Open the Attached Material (I) (Details of Sales in the Present Period) of the VAT Return to fill in it, and then click the [Save] button below.

6. Fill in and save the Attached Material I, Attached Material II, Attached Material III, Main VAT Return, and Additional Taxes Return. After all forms required and selected to fill in are saved, click the [File] button below.

7. Confirm that every item is correct, and then click [OK].

After completion of the above-mentioned operations, the system will submit the filing and automatically compute and judge whether taxpayers meet the conditions for the rebate of period-end VAT retained.

If you meet the conditions for the rebate of period-end VAT retained, the following operation should be divided into two cases:

Case 1: For the taxpayers applicable to the conditions for the rebate of general VAT retained regulated in the Announcement of the Ministry of Finance, State Taxation Administration and General Administration of Customs on Policies Related to the Deepening of VAT Reform (Announcement No. 39 [2019]), the system will pop up the prompt of policies to be enjoyed and show the starting and completion time of all analyses meeting the conditions that the incremental VAT retained is bigger than zero for six consecutive months (or two consecutive quarters in case of tax payment by quarter), and the incremental VAT retained newly increased in the sixth month is not lower than RMB500,000 as compared with that at the end of March 2019, and the page is as shown below:

If it meets the conditions in the analysis period of 6 consecutive months including the current month, the system will also present it at real time.

If taxpayers have applied for the rebate of VAT retained according to some 6 months (2 consecutive quarters) in the previous period, all tax periods meeting conditions before the expiry of the period to which the analysis belongs will be hidden, and the pushing of analysis period will be more precise.

Case 2: For the taxpayers applicable to the conditions for the rebate of VAT retained for advanced manufacturing regulated in the Announcement of the Ministry of Finance and the State Taxation Administration on Clarifying the Policies on the Refund of Term-End Excess Input Value-Added Tax Credits in Certain Advanced Manufacturing Industries (Announcement No. 84 [2019]), the system will pop up the prompt of policies to be enjoyed as follows:

To meet the standard of advanced manufacturing, taxpayers should deal with the national standard industries (primary industries), which are non-metallic mineral products (30), general equipment manufacturing (34), special equipment manufacturing (35) as well as computer, communications and other electronic equipment manufacturing (39), and their sales in the aforesaid industries should account for more than 50% of their total sales.

The follow-up operation is also divided into two options, respectively as follows:

Option 1: Click [Apply for the Rebate of VAT Retained Now]. The system will skip on the same page to the function of “Rebate of Period-end VAT Retained (2019)”, and taxpayers may directly apply for the rebate of VAT retained.

First step: Fill in the form.

1. It is popped up automatically by the taxpayer information system.

2. Select “Whether Advanced Manufacturing Or Not”, and then fill in the different contents popped up. (Advanced manufacturing is applicable to the policy stated in the Announcement No. 84 [2019] of the Ministry of Finance and the State Taxation Administration, and the content in the interface is slightly different from that for non-advanced manufacturing.)

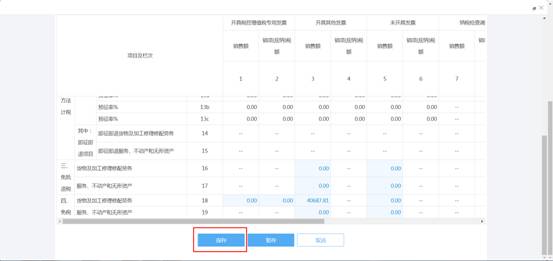

The application form for non-advanced manufacturing is as shown below:

The application form for advanced manufacturing is as shown below:

Fill in the application information according to facts, and then click [Next] to enter the preview page.

Second step: Preview and submit the form.

Attached material is not required for this matter. Click [Next] to enter “Preview the Form”. If there is no problem, click [Submit]. If there is any problem, click [Back] to make correction.

On the pop-up confirmation interface, click [OK].

Third step: Tax affairs are completed successfully.

The acceptance state of the matters successfully submitted can be queried in “I Want to Query” —“Query about the Progress and Result Information of Tax Handling”.

Click “View” to query the details.

The matter is completed.

After the matter is accepted by tax authorities, taxpayers may download the Notice of Tax Matters, as shown below:

The format of the Application Form for Tax Rebate (Retained) is as shown below:

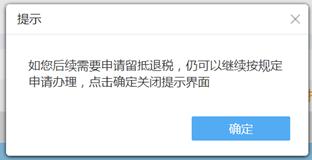

Option 2:Click [Don’t Apply for the Rebate of VAT Retained Yet] or [Don’t Apply for the Rebate of VAT Retained], and the system will pop up the prompt automatically:

Taxpayers can file an application for rebate of tax anytime within the filing period of the same month through I Want to Handle Tax Affairs ——Management on General Tax Rebate (Retained) —— Refund of Period-end VAT Retained (2019).

相关政策:

《国家税务总局关于办理增值税期末留抵税额退税有关事项的公告》(国家税务总局公告2019年第20号)

自2019年4月1日起,同时符合以下条件的纳税人,可以主动向主管税务机关申请退还incremental VAT retained:

1.自2019年4月税款所属期起,连续六个月(按季纳税的,连续两个季度)incremental VAT retained均大于零,且第六个月incremental VAT retained不低于50万元;

2.纳税信用等级为A级或者B级;

3.申请退税前36个月未发生骗取留抵退税、出口退税或虚开增值税专用发票情形的;

4.申请退税前36个月未因偷税被税务机关处罚两次及以上的;

5.自2019年4月1日起未享受即征即退、先征后返(退)政策的。

incremental VAT retained,是指与2019年3月底相比新增加的期末留抵税额。

纳税人当期允许退还的incremental VAT retained,按照以下公式计算:允许退还的incremental VAT retained=incremental VAT retained×进项构成比例×60%

特殊政策

《财政部 税务总局关于明确部分先进制造业rebate of period-end VAT retained政策的公告》(财政部 税务总局公告2019年第84号)

自2019年6月1日起,同时符合以下条件的部分先进制造业纳税人,可以自2019年7月及以后纳税申报期向主管税务机关申请退还incremental VAT retained:

1.incremental VAT retained大于零;

2.纳税信用等级为A级或者B级;

3.申请退税前36个月未发生骗取留抵退税、出口退税或虚开增值税专用发票情形;

4.申请退税前36个月未因偷税被税务机关处罚两次及以上;

5.自2019年4月1日起未享受即征即退、先征后返(退)政策。

部分先进制造业纳税人当期允许退还的incremental VAT retained,按照以下公式计算:允许退还的incremental VAT retained=incremental VAT retained×进项构成比例

纳税人申请办理留抵退税,应于符合留抵退税条件的次月起,在增值税纳税申报期(以下称申报期)内,完成本期增值税纳税申报后,通过electronic tax service 或办税服务厅提交《退(抵)税申请表》。

搜索

搜索

搜索

搜索 导航

导航